In presenting his budget proposal to the Greenbelt City Council on March 25, City Manager Josué Salmerón had good news. Despite earlier projections of a multimillion-dollar budget deficit in the Fiscal Year (FY) 2025 which begins July 1, the budget deficit has been closed without increasing the city tax rate. Council began its review of the budget at a March 27 worksession with the budget overview.

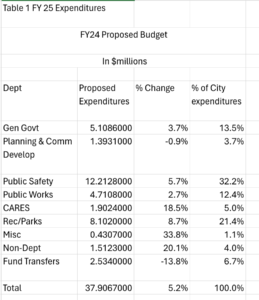

Expenditures

This story will focus on the General Fund, which is the city’s operating budget. The city also has several other funds, which will be covered as part of the coming worksession reporting.

Salmerón is proposing total expenditures of $36.6 million versus revenues of $37.5 million, leaving a surplus of $842,300. He said this leaves the city in a good position should an economic downturn occur. (See Table 1 on page 10 for department level expenditures.)

Two smaller accounts, Non-Departmental and Miscellaneous have relatively large percentage increases. The non-departmental increase is due to an increase in Workers Compensation premiums. There are two drivers of the increase in Miscellaneous: increased salary and benefits for the Greenbelt Connection and the proposal to give sizeable contributions to several new groups: The SPACE ($20,000), the Greenbelt Business Alliance ($5,000), the Refugee Aid Committee ($5,000), and other, smaller additions. In addition, the contribution to the Greenbelt Soccer Alliance is proposed to rebound to its previous level ($4,000) after dropping to $2,500 in FY24.

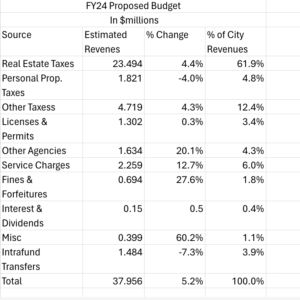

Revenues

Salmerón said that council had directed that there be no property tax increase in FY25. Mayor Emmett Jordan noted that the property tax rate had not changed in six years. Real and personal property taxes account for roughly two-thirds of the city’s projected revenue. City Treasurer Bertha Gaymon expressed concern about the city relying so heavily on property tax revenue. While the city managed to balance the budget without raising taxes for the coming year, she does not see this as sustainable. At some point, she said, the city will need to make decisions as to whether to raise taxes or reduce expenditures.

Revenues by Source

See Table 2 for a breakdown of estimated revenues by source. The increase in “other taxes” is driven by continuing rebound of the admissions and amusements tax and the hotel/motel tax post-Covid and by an increase in highway tax revenues. The increase in revenue from other agencies is due to an increase in the state police protection grant. The increase in service charge revenue is mostly due to recreation-related fees. However, Salmerón cautioned that substantial repairs are needed for the pool, the cost of which is not yet reflected in the budget. The increase in fines and forfeitures is largely related to increasing red-light camera violations.

Charlestowne North

Although the city assessed significant fines related to Charlestowne North, these have not resulted in an increase in the municipal infractions revenue estimate as the city may negotiate some of these fees as a carrot for the new owner to bring the property back into compliance.

Salmerón also calls for transferring $1.5 million from the Capital Reserve (part of the city’s general fund balance) to the General Fund account.

Salmerón is proposing to keep city refuse and recycling fees unchanged.

Staffing

Salmerón is proposing a net increase of two full-time positions. Two positions previously funded through the American Rescue Plan Act (ARPA), a crisis intervention counselor and a CARES counselor, will now be funded using city revenues. The Recreation Department will add 2.5 full-time equivalents (FTE), Greenbelt CARES will gain one-half FTE and Public Works will lose one position (parks supervisor for playgrounds, currently vacant.).

The executive assistant position in the administration budget has been eliminated. In its place Salmerón is proposing to create a lower-grade constituent services coordinator. The coordinator will report directly to Salmerón and assist him in responding to requests from residents such as providing hands-on involvement in situations like Charlestowne North, public safety issues not within the police department’s jurisdiction, coordinating with county and state resources and attending meetings with homeowners’ associations and civic organizations.

The departments will also designate special event coordinators from among existing staff to be sure all necessary arrangements are made.

Salaries

Under the proposed budget, employees will receive a two percent cost of living increase, and up to a three percent merit increase, tied to performance. Salmerón also recommends that the city should continue expanding nonclassified benefits by introducing vacation time and formalize a policy giving nonclassified staff the cost-of-living adjustment just as classified staff receive. He also proposed exploring a second tier of nonclassified staff for positions requiring certifications or special training.

ARPA

While many of the ARPA programs will be winding down, Salmerón has budgeted for the city’s supplementation of the food distribution programs to continue with city revenues supplanting the ARPA funding, once that runs out. Staff will need to continue monitoring and adjusting spending on ARPA-related projects until the program ends.

Ongoing Issues

Crime reduction is a top priority for city staff. The police department will work with other city departments and partner agencies to reduce crime and the fear of crime citywide and to identify repeat offenders.

Office and facility space continues to be a problem. While council and staff have done some needs assessment work for a new building; a new building, if built at all, is years away. Salmerón and team will be exploring ways to make more efficient use of the space it has, as is being done with the ground floor of the Municipal Building.

Another initiative is to provide more services in Spanish and other languages. CARES now has counselors who speak English, Spanish, French and Arabic. There is also a desire among council for more documents to be made available in languages other than English.

Want More?

There is a wealth of information in the 297-page budget document. The manager’s letter to council, his description of issues facing the city, his vision for the city’s future and the foundational pillars of the budget such as sustainability, forward thinking and diversity, equity and inclusion. To view the document on the city’s website, go to greenbeltmd.gov/government/city-administration/finance/city-budget/-folder-1568.